Apply for PM Youth Business & Agriculture Loan

Young entrepreneurs and farmers across Pakistan often struggle with finances when preliminary or increasing a business. To support them, the Government of Pakistan presented the PM Youth Business & Agriculture Loan Scheme 2025. This program provides reasonable financing, little interest taxes, and easy payment plans. Whether you want to presentation a startup, promotion your farming setup, or grow your existing commercial, this arrangement is a golden chance for you.

Below is the complete, updated info about the scheme with eligibility, groups, required leaflets, application steps, and how to check your loan status online.

Quick Information Table for Apply for PM Youth Business & Agriculture Loan

| Detail | Information |

|---|---|

| Program Name | PM Youth Business & Agriculture Loan Scheme 2025 |

| Start Date | January 2025 |

| End Date | Applications open year-round (subject to government updates) |

| Loan Amount | Rs. 0.5 million to Rs. 7.5 million |

| Loan Type | Interest-free & low-interest business & agriculture loans |

| Application Method | 100% Online (pmyp.gov.pk) |

What is the PM Youth Business & Agriculture Loan Scheme 2025?

The PM Youth Business & Agriculture Loan Scheme is a government-funded inventiveness below the Kamyab Jawan Program. It aims to:

- Support young Pakistanis in starting businesses

- Reduce unemployment

- Promote entrepreneurship, agriculture, IT, and small industries

The government provides interest-free loans, low-interest loans, and market-based loans divided into different tiers to support people according to their financial needs.

More Read: PM Laptop Scheme 2025 Phase 5

Key Features of the Apply for PM Youth Business & Agriculture Loan 2025

Loan Tiers and Their Benefits

| Feature | Details |

|---|---|

| Tier 1 | Up to Rs. 500,000 (Interest-Free, No Collateral Required) |

| Tier 2 | Rs. 500,000 – 1.5 million (Low-Interest Loan) |

| Tier 3 | Rs. 1.5 million – 7.5 million (Market-Based Rates) |

| Repayment Period | Up to 8 years with a 1-year grace period |

| Women Quota | 25% seats reserved for women |

| Eligibility | Open for all Pakistanis including AJK & GB |

This scheme supports farmers, women, startups, e-commerce businesses, IT graduates, small shopkeepers, and many more.

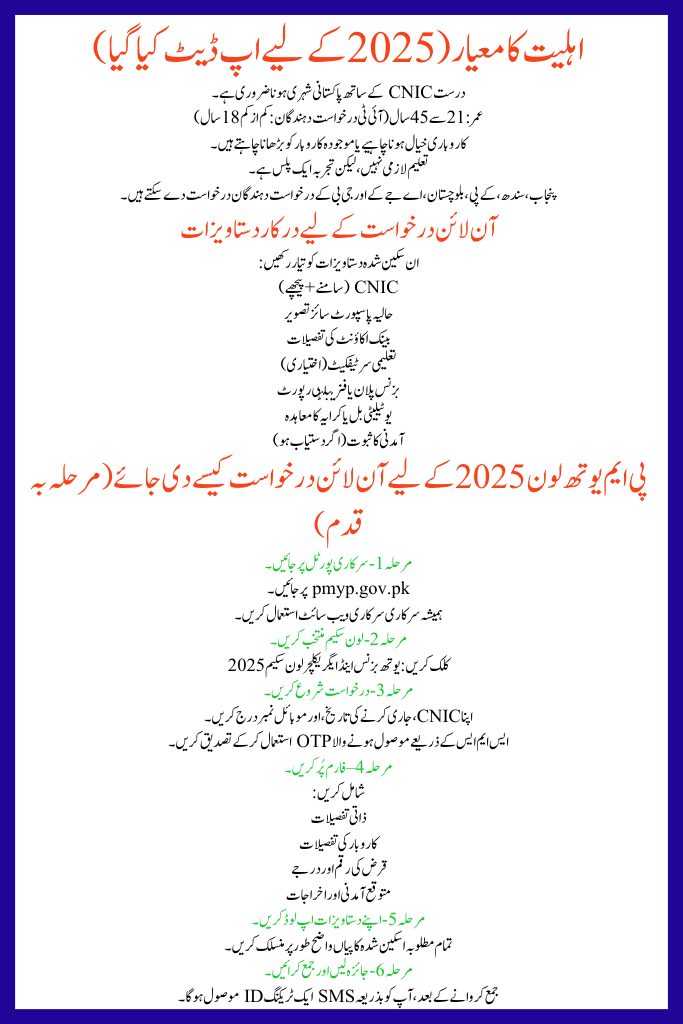

Eligibility Criteria (Updated for 2025)

- Must be a Pakistani citizen with valid CNIC

- Age: 21 to 45 years (IT applicants: minimum 18 years)

- Must have a business idea or want to expand an existing business

- Education not mandatory, but experience is a plus

- Applicants from Punjab, Sindh, KP, Balochistan, AJK & GB can apply

Required Documents for Online Application

Keep these scanned documents ready:

- CNIC (Front + Back)

- Recent passport-size photograph

- Bank account details

- Educational certificates (optional)

- Business plan or feasibility report

- Utility bill or rental agreement

- Proof of income (if available)

How to Apply Online for PM Youth Loan 2025 (Step-by-Step)

Step 1 – Visit Official Portal

Go to: pmyp.gov.pk

Always use the official government website.

Step 2 – Select Loan Scheme

Click: Youth Business & Agriculture Loan Scheme 2025

Step 3 – Start Application

- Enter your CNIC, issue date, and mobile number

- Verify using OTP received via SMS

Step 4 – Fill Out the Form

Include:

- Personal details

- Business details

- Loan amount & tier

- Expected income & expenses

Step 5 – Upload Your Documents

Attach all required scanned copies clearly.

Step 6 – Review and Submit

Once submitted, you will receive a Tracking ID via SMS.

What Happens After Submission?

Your application goes through:

- Initial screening

- Forwarding to the selected bank

- Document verification

- Interview or physical verification (if needed)

- Approval or rejection

- Loan disbursement

Processing Time: 30–60 days

How to Check PM Youth Loan Status Online (2025)

Method 1 – Through Official Website

- Visit pmyp.gov.pk

- Click Application Status

- Enter CNIC & Tracking ID

- View real-time status

Method 2 – Through Bank Branch

Visit the bank where your application was submitted.

Method 3 – SMS Alerts

Many banks send updates via SMS.

Tips for a Successful Loan Application

- Submit a clear, realistic business plan

- Ensure all documents are valid and updated

- Double-check your details

- Respond quickly to bank calls or messages

More Read: Parwaz Card For Students Living Abroad

FAQs – PM Youth Loan 2025

What is the last date to apply?

Applications are open throughout 2025 unless the government announces updates.

Can women apply?

Yes, 25% quota is reserved for women.

How long does approval take?

Typically 30–60 days.

Can I apply for more than one tier?

No, only one tier is allowed.

Conclusion

The PM Youth Business & Agriculture Loan Scheme 2025 is one of Pakistan’s biggest financial support programs for youth. With interest-free backing, easy online application, and support for multiple business sectors, this scheme can help you start or expand your business confidently.

If you want to build your future, now is the right time. Visit pmyp.gov.pk today and smear online!

Latest Updates

Punjab Forest Department Jobs 2026 – High Salary GIS & Government Vacancies Announced

Punjab Forest Department Jobs 2026 – High Salary GIS & Government Vacancies Announced Urgent Update: Punjab Class 9 and 10 Exam Schedule 2026 Revealed

Urgent Update: Punjab Class 9 and 10 Exam Schedule 2026 Revealed Saudi Arabia Qatar Bahrain, and Kuwait May Ease Visas for Pakistanis – Complete & Updated Guide 2026

Saudi Arabia Qatar Bahrain, and Kuwait May Ease Visas for Pakistanis – Complete & Updated Guide 2026 Good News for Pakistani Students Planning to Study in Germany (2026 Update)

Good News for Pakistani Students Planning to Study in Germany (2026 Update) Current News: Major Fee Relief for Matric and Intermediate Students Announced

Current News: Major Fee Relief for Matric and Intermediate Students Announced Bank Alfalah Offers HP Laptops on 0% Markup Installments – Complete Details 2026

Bank Alfalah Offers HP Laptops on 0% Markup Installments – Complete Details 2026