PM Youth Loan Scheme

The Prime Minister Youth Loan Scheme 2025 is one of the most significant creativities launched to authorize the youth of Pakistan. Finished this scheme, young menfolk and females can apply for easy, low-markup business advances to start or expand their businesses. The complete request procedure is online, and after applying, you can also check your loan status online without staying any bank branch.

Whether you want to start an online business, a shop, farming setup, livestock undeveloped, IT startup, or expand an existing business this scheme is designed to support you monetarily.

Quick Information Table for PM Youth Loan Scheme

| Program Name | Start / Latest Update | Loan Amount | Markup Rate | Application Method |

|---|---|---|---|---|

| PM Youth Loan Scheme 2025 | Updated January 2025 | PKR 0.5 million – PKR 7.5 million | 0% – 7% (Based on Tier) | Online via PMYP Portal |

What Is PM Youth Loan Scheme 2025?

The PM Youth Loan Scheme 2025 (PMYLS) is a government fiscal support database that aids young Pakistanis become self-employed. Instead of waiting for jobs, the government inspires youth to start their own trades by providing easy loans with minimum markup and flexible installment plans.

The scheme offers loans finished major banks across Pakistan, counting NBP, BOP, HBL, UBL, Meezan Bank, etc.

Purpose of the PM Youth Loan Scheme 2025

The main goals of this PM Youth Loan Scheme 2025 – Check Application Status Online are:

- Encourage entrepreneurship in Pakistan

- Support youth in launching new businesses

- Strengthen small and medium enterprises

- Create employment opportunities

- Support agriculture, livestock, IT, e-commerce and manufacturing sectors

This scheme plays a big role in reducing unemployment and helping young Pakistanis become financially independent.

More Read: PM Laptop Scheme 2025 Phase 5

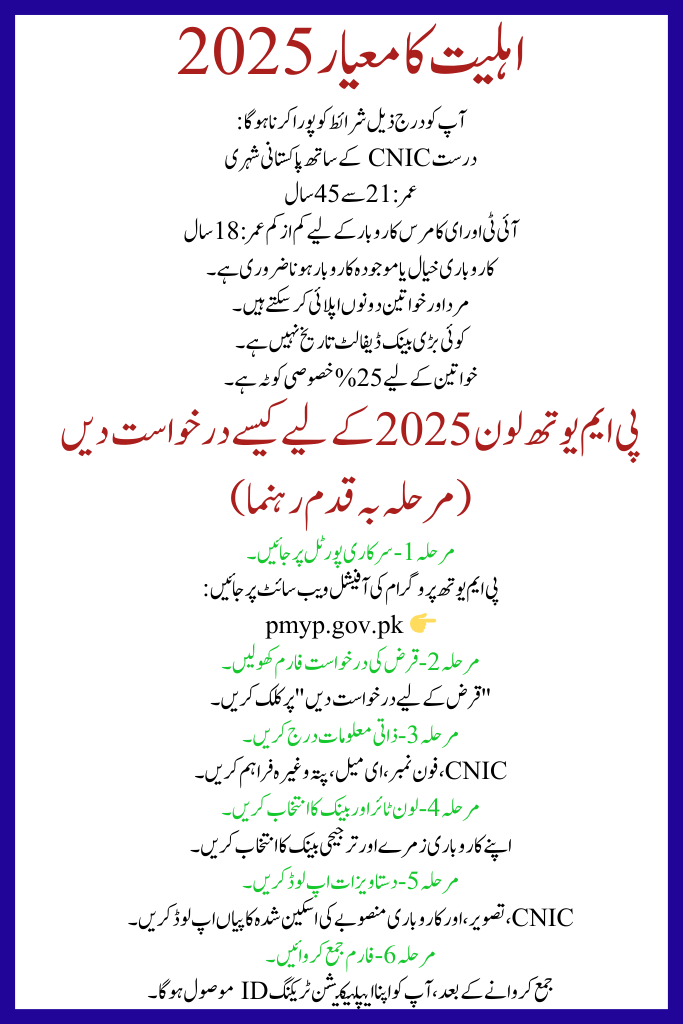

Eligibility Criteria 2025

You must meet the following conditions:

- Pakistani citizen with valid CNIC

- Age: 21 to 45 years

- Minimum age for IT & e-commerce businesses: 18 years

- Must have a business idea or existing business

- Both men and women can apply

- No major bank default history

- Women have 25% special quota

Loan Categories (Tiers) & Markup Rate

The loan system is divided into three tiers:

Tier 1

- Loan Amount: PKR 100,000 – 500,000

- Markup: 0% (Interest-Free)

- Repayment Time: 3 – 5 years

Tier 2

- Loan Amount: PKR 500,000 – 1.5 million

- Markup: 5%

- Repayment Time: 5 – 7 years

Tier 3

- Loan Amount: PKR 1.5 million – 7.5 million

- Markup: 7%

- Repayment Time: Up to 8 years

Required Documents for PM Youth Loan Scheme 2025 – Check Application Status Online

Mandatory Documents

- CNIC (front & back)

- Passport-size photo

- Bank account details

- Mobile number registered on CNIC

- Business plan or idea

Optional Documents (Increase Approval Chances)

- Experience certificates

- Income proof

- Educational certificates

- Business registration (if applicable)

How To Apply for PM Youth Loan 2025 (Step-by-Step Guide)

Step 1 – Visit the Official Portal

Go to the official PM Youth Program website:

👉 pmyp.gov.pk

Step 2 – Open Loan Application Form

Click on “Apply for Loan”.

Step 3 – Enter Personal Information

Provide CNIC, phone number, email, address, etc.

Step 4 – Choose Loan Tier & Bank

Select your business category and preferred bank.

Step 5 – Upload Documents

Upload scanned copies of CNIC, photo, and business plan.

Step 6 – Submit Form

After submitting, you will receive your Application Tracking ID.

How to Check PM Youth Loan Application Status Online

There are three official methods:

Method 1 – Official Website (Most Used)

- Visit PMYP portal

- Click “Track Application”

- Enter your CNIC + Tracking ID

- Your status will appear:

Possible Status Types

| Status | Meaning |

|---|---|

| Under Review | Documents being checked |

| Approved | Loan is accepted |

| Rejected | Requirements not met |

| Pending | Additional documents required |

Method 2 – Contact Bank

Go to the branch of the selected bank and provide CNIC or Tracking ID.

Method 3 – SMS or Call Helpline

Some banks send SMS alerts when the application moves forward.

More Read: IIUI Begins Laptop Distribution 2025

Reasons for Rejection or Delay

- Business plan not clear

- CNIC mismatch

- Incorrect information

- Missing documents

- Bank verification delay

- Low credit score

What To Do If Your Application Is Rejected

- Improve business plan

- Correct wrong details

- Attach complete documents

- Reapply after correction

- Choose another bank

Participating Banks in 2025

- National Bank of Pakistan (NBP)

- Bank of Punjab (BOP)

- Habib Bank Limited (HBL)

- Meezan Bank

- United Bank Limited (UBL)

- Allied Bank

- Zarai Taraqiati Bank (ZTBL)

Conclusion

The PM Youth Loan Scheme 2025 – Check Application Status Online is a life changing occasion for young Pakistanis who want to build their future. With easy online application, low rise rates, flexible payments, and quick status checking the process is now simpler than ever. If you have a business idea, this is the best time to apply and safe your fiscal upcoming.

Latest Updates

Punjab Forest Department Jobs 2026 – High Salary GIS & Government Vacancies Announced

Punjab Forest Department Jobs 2026 – High Salary GIS & Government Vacancies Announced Urgent Update: Punjab Class 9 and 10 Exam Schedule 2026 Revealed

Urgent Update: Punjab Class 9 and 10 Exam Schedule 2026 Revealed Saudi Arabia Qatar Bahrain, and Kuwait May Ease Visas for Pakistanis – Complete & Updated Guide 2026

Saudi Arabia Qatar Bahrain, and Kuwait May Ease Visas for Pakistanis – Complete & Updated Guide 2026 Good News for Pakistani Students Planning to Study in Germany (2026 Update)

Good News for Pakistani Students Planning to Study in Germany (2026 Update) Current News: Major Fee Relief for Matric and Intermediate Students Announced

Current News: Major Fee Relief for Matric and Intermediate Students Announced Bank Alfalah Offers HP Laptops on 0% Markup Installments – Complete Details 2026

Bank Alfalah Offers HP Laptops on 0% Markup Installments – Complete Details 2026